In the fast-paced world of trading, mastering candlestick patterns can be the difference between merely surviving and consistently thriving. This comprehensive guide equips you with advanced knowledge, empirical data, and practical steps to harness candlestick analysis for profitable decision-making.

From beginner concepts to rare formations, you’ll learn how to integrate psychological and technical insights into a risk-managed system that elevates your strategy.

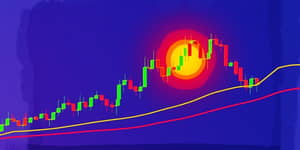

Candlestick charts originated in 18th-century Japan, yet they remain one of the most powerful tools in modern technical analysis. Each candlestick represents four crucial data points: open, high, low, and close.

When interpreted correctly, these shapes reveal ongoing battles between buyers and sellers, guiding traders toward support and resistance levels and potential breakouts.

Advanced traders categorize patterns into reversal and continuation types. Reversal patterns signal a potential shift in trend, while continuation patterns indicate consolidation before the prevailing trend resumes.

Key reversal formations include:

Continuations, although less dramatic, are equally valuable when used during range-bound markets or minor pullbacks.

Not all patterns perform equally. Studies and real-world examples reveal which formations consistently yield powerful reversal signals.

• Bullish/Bearish Engulfing at major swing points is often hailed as one of the most dependable. For instance, Morgan Stanley’s stock price doubled in 18 months after a textbook bullish engulfing at a long-term support line.

• Morning Star Doji exhibits a success rate of approximately 68% over ten years, according to Dr. Emily Chen’s 2022 study.

Below is a summary of empirical findings:

Candlesticks reflect the tug-of-war between bulls and bears. A series of large bodies, or large momentum candles, typically corresponds with surges in aggressive buying or selling.

However, patterns are most trustworthy when they occur at clear support/resistance zones or swing highs and lows. In isolation, they risk becoming false signals or “traps.”

Confluence with other tools—moving averages, RSI, order flow—boosts probability and helps filter noise.

A robust candlestick-based strategy combines entry triggers, stop placements, and profit targets.

Entry guidelines:

Stop-loss orders should be placed just beyond the reversal candle’s extreme, aligned with nearby swing points.

Profit-taking methods include measured moves (equal to pattern height) or using trailing stops to capture extended trends.

Always position size according to your overall risk tolerance—a pattern’s statistical edge can evaporate if you risk too much per trade.

Even seasoned traders fall into traps when relying solely on candlesticks. Over-trading is rampant, as is ignoring the broader market context.

Key pitfalls:

Successful practitioners refine their approach by combining candlesticks with technical indicator confluence and practicing disciplined exit strategies.

Consider a hypothetical backtest on a major currency pair over five years. When bullish engulfing patterns occurred at daily swing lows with RSI under 30, the strategy yielded an average return of 1.8% per trade, with a win rate of 57%.

By contrast, signals in choppy markets dropped below 45% win rate, underscoring the importance of context.

Candlestick patterns remain a cornerstone of technical analysis. Their visual clarity and psychological depth offer traders a nuanced lens on market sentiment.

Nevertheless, they must be wielded as part of a broader analytical framework, incorporating risk management, trend analysis, and confirmation tools.

By studying empirical data, backtesting diligently, and respecting market dynamics, you can unlock the full potential of market psychology cycles and achieve more consistent, profitable results.

References