Seasonality in financial markets unlocks hidden edges for traders who learn to anticipate predictable and recurring patterns. By aligning entry and exit points with these cyclical tendencies, investors can tilt probabilities in their favor while managing uncertainties inherent in global markets.

Across equities, commodities, and forex, the interplay of calendar events, weather cycles, and institutional behaviors creates distinct windows of opportunity. This article explores how to harness seasonal rhythms, blending quantitative rigor with disciplined risk controls for robust trading strategies.

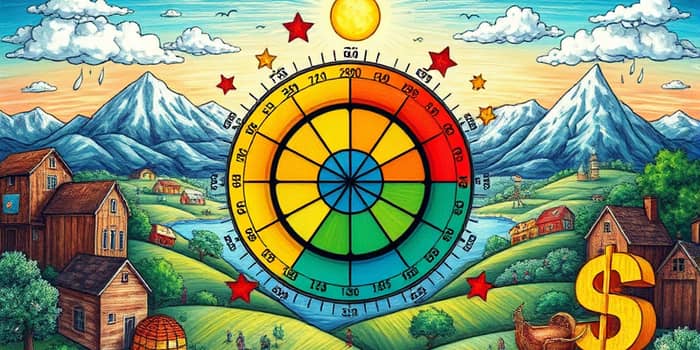

Seasonality refers to recurring price tendencies that manifest at specific times of the year. Academic research and empirical data confirm that these cycles span asset classes—from the “Santa Claus rally” in stocks to harvest-related moves in agribusiness.

Key drivers include institutional portfolio rebalancing, fiscal deadlines, holiday-induced sentiment shifts, and natural cycles like planting and heating demand. By recognizing these forces, traders can forecast periods of strength or caution.

Historical averages illustrate that certain calendar segments consistently deliver above-average returns:

Stocks exhibit quarterly rebalancing and psychology-driven trends. Commodities follow natural cycles—spring planting, summer demand, winter heating. In forex, liquidity and volatility ebb around major holidays and financial year-ends, creating exploitable windows.

By comparing these dynamics, traders can diversify seasonal strategies across multiple markets, smoothing out idiosyncratic risks and maximizing the impact of recurring trends.

Effective seasonal trading relies on robust analysis. Leverage quantitative data analysis and backtesting using platforms like TradingView, LuxAlgo, or custom Python scripts. Validate each pattern against historical cycles to avoid false positives and confirm statistical significance.

Complement this with technical indicators—momentum oscillators, moving averages, and candlestick patterns—to refine entry triggers and exit signals. Blending quantitative and technical layers enhances confidence in trade setups.

While seasonality offers an edge, it demands disciplined safeguards. Always implement a solid risk management is crucial framework with defined stop-loss levels and preset risk/reward ratios. Position sizing should reflect volatility and account exposure to seasonal swings.

Remember that patterns are probabilities, not certainties. Unexpected geopolitical events or economic shocks can override historical cycles. Combining seasonal insights with fundamental analysis can mitigate surprises and preserve capital.

Data-mining bias can create spurious relationships that collapse in live trading. As more participants adopt seasonal tactics, visible patterns may erode. Always stress-test strategies under various market regimes.

Be mindful of economic shocks or geopolitical events that defy calendar norms. Tailor your approach with adaptive filters, adjusting exposure when fundamentals or volatility regimes depart from seasonal expectations.

Mastering seasonal strategies often work best when they become part of a diversified toolkit. By integrating calendar-based approaches with rigorous analysis and disciplined risk controls, traders can gain a statistical edge while guarding against unpredictable market forces.

Embrace the rhythm of the seasons, stay vigilant for regime shifts, and let recurring trends guide your decisions toward consistently smarter, more informed trades.

References